By crossborderfees October 11, 2025

Cross-border chargebacks are a reality for any business selling to customers in other countries. Whether you run an eCommerce brand shipping globally or accept in-person cards from international travelers, cross-border chargebacks can strain operations, reduce margins, and complicate compliance.

This guide explains how cross-border chargebacks work, why they happen, and how to prevent and fight them effectively. You’ll learn the latest dispute program updates, how issuer expectations shift by region, and what evidence actually wins card-not-present cases.

Throughout, we’ll use practical terms and clear steps so your team can confidently manage cross-border chargebacks while protecting revenue and customer trust.

What is a Cross-Border Chargeback and How Is It Different?

A chargeback occurs when a cardholder disputes a transaction with their card-issuing bank and the bank reverses the payment. A cross-border chargeback is that same dispute—just with an extra layer of complexity because the cardholder and merchant are in different countries or the transaction routes across international borders.

Currency conversion, network rules, local regulations, and fraud patterns vary by market, and those differences can alter your liability, your response timelines, and the evidence you must present to win.

With cross-border chargebacks, your authorization might clear through a local acquirer, a cross-border acquirer, or a global PSP. Each routing decision can influence interchange, acquirer markup, and your dispute rights.

Language barriers can hinder communication with customers and issuers, while time-zone gaps compress your internal response windows. Even small details—like how your descriptor appears in a foreign banking app—can swing “I don’t recognize this” complaints into formal cross-border chargebacks.

Understanding these friction points is the first step to reducing dispute rates and preserving authorization performance across regions.

From a cost perspective, cross-border transactions can carry higher interchange and assessment fees, and many providers add extra dispute handling costs if a case moves to arbitration or pre-arbitration across regions.

You also face higher false-positive risk if fraud filters are tuned to domestic patterns. All of this makes cross-border chargebacks more expensive and harder to manage—unless you intentionally design processes, descriptors, and evidence for global sales.

The Cross-Border Chargeback Lifecycle (and Where It Deviates)

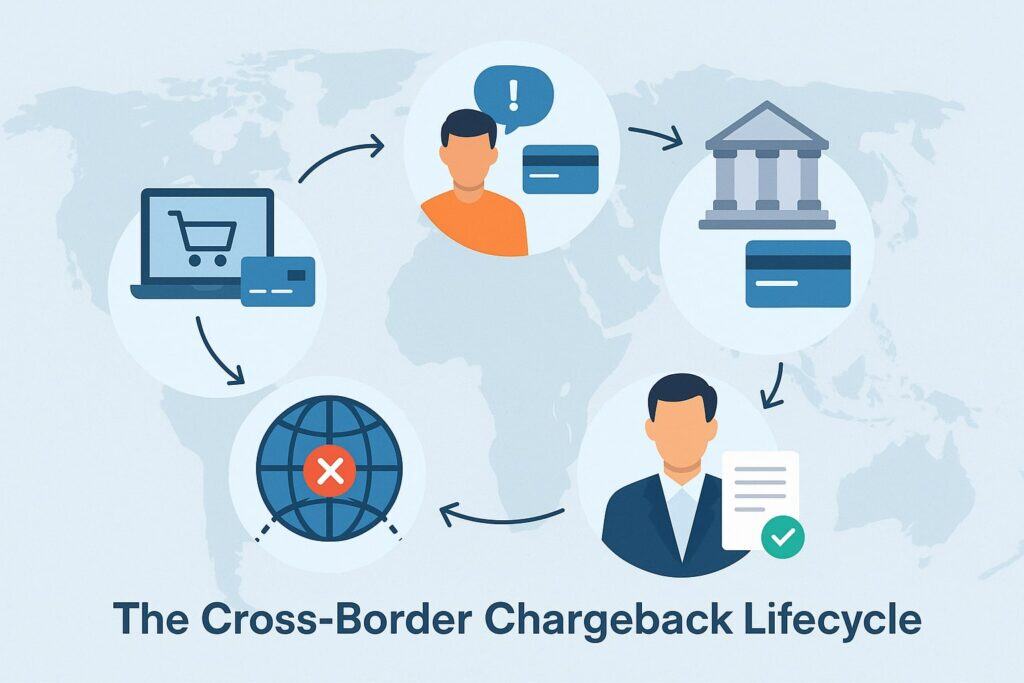

The lifecycle of cross-border chargebacks looks familiar—cardholder complaint, issuer review, provisional credit, evidence exchange, and potential arbitration. But several points deviate:

- Intake and Inquiry: Issuers in different countries may prioritize resolution tools differently. Some rely on data-sharing programs that give cardholders richer receipts before they ever file a dispute.

When your purchase details appear instantly inside the issuer’s app, “unrecognized” complaints can be resolved without becoming cross-border chargebacks. Mastercard’s Consumer Clarity, for example, delivers enhanced order details directly to issuers to reduce confusion at the first-contact stage. - Pre-Dispute Stage: For Visa cards, Verifi’s Order Insight and Rapid Dispute Resolution (RDR) can settle issues automatically before a formal chargeback starts.

Merchants configure rules to auto-refund certain claims at the inquiry stage, preventing cross-border chargebacks from counting against ratios. - Network Workflows: Visa’s allocation model and Mastercard’s collaboration model govern who investigates first and what evidence is required.

In cross-border contexts, message formats, reason codes, and liability may shift slightly due to regional program matrices and acquirer setup. Mastercard’s dispute guides outline categories and workflows that your acquirer will map for you. - Timelines and Evidence Delivery: Holidays, weekends, and bank working days differ by country. If your team operates in one time zone but issuers sit across the globe, build internal SLAs that are 24–48 hours faster than the formal network deadline to accommodate delays.

Provide localized documents (translation, local date formats) to avoid misunderstandings that can sink cross-border chargebacks. - Arbitration Costs: If a case escalates, fees can be higher and settlements slower. Make sure finance teams forecast dispute reserves for key cross-border corridors and monitor win-rate by market to avoid surprises.

Common Causes of Cross-Border Chargebacks (and the Fixes That Work)

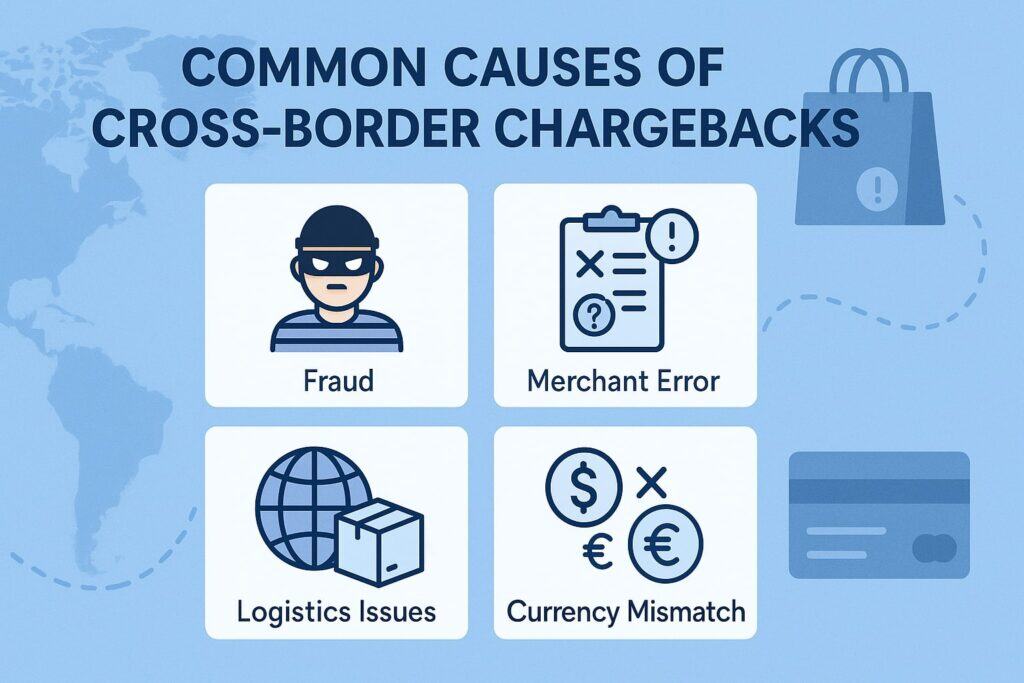

Cross-border chargebacks often stem from a small set of root causes, amplified by the international context:

- Friendly Fraud / First-Party Misuse: The customer or someone in the household made the purchase but later disputes it. Visa’s Compelling Evidence 3.0 (CE3.0) created a stronger framework to challenge these claims when you can tie the disputed purchase to the same user profile with historical data.

- Unrecognized Descriptors: Foreign language descriptors, trading names vs brand names, and missing logos in banking apps trigger confusion. Enrich descriptors and register logos were supported to immediately reduce cross-border chargebacks.

- Logistics & Delivery Issues: Longer shipping times, customs delays, and unclear return routes increase “merchandise not received” or “not as described” claims. Publish corridor-specific delivery windows, offer localized tracking pages, and provide pre-paid return labels for international orders.

- Authentication Gaps: If SCA or 3-D Secure wasn’t applied when required, liability can shift. In the EEA and UK, PSD2 SCA rules make 3DS2 the norm; correct exemptions lower friction while keeping liability aligned.

- Currency & Pricing Confusion: Dynamic currency conversion (DCC), bank FX rates, and cross-border fees can inflate the final charge the cardholder sees. Show a clear “you will be charged” amount, note possible bank FX variances, and provide an FAQ in local language and currency.

Fixes that work focus on transparency, strong authentication, and rapid information-sharing with issuers to deflect cross-border chargebacks before they formalize.

Latest Rule Changes That Matter for Cross-Border Chargebacks

Keeping up with network changes is critical. A few developments have reshaped how merchants should handle cross-border chargebacks:

- Visa Compelling Evidence 3.0 (CE3.0): Effective April 15, 2023, CE3.0 lets merchants rebut certain fraud disputes by providing two prior, non-fraudulent transactions from the same customer made 120–365 days before the dispute, plus matching identifiers like device data or account credentials.

CE3.0 particularly targets first-party misuse in card-not-present transactions, including cross-border sales. - Pre-Dispute Tools—Order Insight & RDR: Verifi’s programs let issuers and merchants exchange enhanced order data and even automate refunds at inquiry time so disputes never become cross-border chargebacks that hit your ratios.

These programs are especially valuable for international transactions where cardholders frequently don’t recognize descriptors. - Mastercard Consumer Clarity & Alerts: Mastercard’s ecosystem (Ethoca) delivers receipts, itemized order details, and merchant logos directly into the issuer experience to deflect disputes.

For cross-border purchases, this transparency addresses language and recognition issues at the source. - SCA & 3DS2 Evolution (EEA/UK): PSD2 Strong Customer Authentication and the widespread use of 3DS2 introduced liability shifts and exemption logic.

Applying 3DS2 correctly—either as a challenge or frictionless with issuer risk-based authentication—reduces fraud and clarifies liability on cross-border chargebacks.

Regional Nuances: How Geography Affects Disputes

Europe, UK, and EEA

In the EEA and UK, Strong Customer Authentication has become standard for eCommerce. Many issuers default to 3DS2, and liability often shifts after successful cardholder authentication.

Merchants should implement 3DS2 with exemption strategies (low-risk transaction exemptions, MIT frameworks, trusted beneficiaries) to preserve conversion while keeping liability aligned.

When selling cross-border into Europe, expect lower tolerance for missing delivery proof and higher expectations for detailed itemization in your evidence package. If you skip SCA where it’s required, cross-border chargebacks on fraud reason codes will be difficult to win.

North America

Authorization rates for cross-border card-not-present transactions can be lower than domestic ones, and issuers rely heavily on enriched data to resolve “unrecognized” disputes.

Participation in Visa Order Insight and Mastercard Consumer Clarity pays outsized dividends here because the cardholder view in the banking app can show your brand, logo, and digital receipts, often preventing cross-border chargebacks at the first click.

APAC and LATAM

In some APAC and LATAM markets, alternative payment methods (APMs) are prominent, and dispute rights differ by method. For cards, 3DS usage varies by country and issuer. Invest in geospecific messaging around delivery times, customs duties, and returns.

Where cash-on-delivery or local wallets dominate, dispute models may rely more on claim portals than card network frameworks—plan your playbooks accordingly to keep cross-border chargebacks low.

Building a Defensible Evidence Package for Cross-Border Chargebacks

Winning cross-border chargebacks requires fast, structured, and localized evidence. Aim to deliver an evidence package that is easily digestible by an issuer analyst who may not speak your language fluently:

- Identity & Behavioral Signals: Device fingerprint, IP geolocation, user agent, account age, login history, and prior successful purchases. Under Visa CE3.0, historical transactions made by the same customer within 120–365 days are powerful first-party misuse rebuttals.

- Order & Delivery Proof: Itemized invoice, shipping label, carrier tracking with delivery confirmation, signature (if available), and cross-border customs documentation. For digital goods, include download logs, access timestamps, and in-app usage tied to the customer profile.

- Customer Communications: Support tickets, emails, and chats showing that the customer engaged post-purchase. If you solved an issue or issued partial credit before the dispute, highlight that to show reasonableness and reduce cross-border chargebacks.

- Descriptor & Refund Policies: A screenshot of the checkout page showing localized currency, tax, and duty disclosures. Include your return instructions for international orders. Issuers prefer to see that the consumer had a clear, culturally appropriate path to resolution.

- Authentication Proof: 3DS2 authentication results, SCA challenge proof, or exemption reason and acquirer approvals. These documents can determine liability on fraud codes in SCA regions.

Bundle these items in a single PDF where possible, translate short summaries when needed, and label each section so an analyst can navigate quickly. Fast, organized evidence reduces back-and-forth and improves your odds on cross-border chargebacks.

Prevention First: How to Reduce Cross-Border Chargebacks Proactively

1) Enrich What Issuers See

Join issuer-merchant data-sharing programs. For Visa cards, implement Order Insight and configure Rapid Dispute Resolution rules to auto-credit low-value or high-risk segments at the inquiry stage.

For Mastercard cards, enable Ethoca Consumer Clarity so cardholders see your brand logo, itemized receipt, and geolocation details in their banking app. These steps deflect unrecognized transactions and shrink cross-border chargebacks before they start.

2) Authenticate Intelligently

Use 3DS2 with data-rich requests so issuers can approve more frictionless authentications. In SCA regions, apply exemptions appropriately and fall back to challenge when risk is elevated.

Preserve conversion by letting issuers make risk-based calls, but keep your audit trail tight for any future cross-border chargebacks.

3) Localize Checkout and Post-Purchase

Show the pay-now amount clearly, note possible bank FX differences, and provide delivery windows and returns in local language. Use recognizable brand descriptors and register your logo with participating programs so it renders in issuer apps. Clarity lowers cross-border chargebacks tied to confusion.

4) Tune Fraud Controls by Corridor

Fraud behavior varies by country. Segment rules by corridor (BIN, country, currency) and monitor false-positives vs approvals. Pair risk controls with enhanced issuer data-sharing so genuine customers aren’t forced into disputes that become cross-border chargebacks.

5) Set Internal SLAs & Ownership

Create a “follow-the-sun” dispute desk or assign markets to regional teams so no deadline slips because of time zones. Use a standard evidence template for cross-border chargebacks and pre-translate your most common statements.

Working With Acquirers, PSPs, and Solution Partners

A good acquirer or PSP is your first line of defense against cross-border chargebacks. Ask these questions during vendor selection and quarterly reviews:

- Do you support Visa Order Insight, RDR, and Mastercard Consumer Clarity end-to-end? If they rely on third-party brokers, ensure data flows remain timely to stop cross-border chargebacks at intake.

- What’s your cross-border authorization and dispute win-rate by corridor? Compare markets, product types, and average tickets.

- Can you surface CE3.0-ready behavioral data automatically in your evidence exports? That reduces manual work and improves outcomes under Visa’s updated rules.

- How do you handle multi-currency settlement and descriptor localization? Aligned descriptors and clean FX disclosures reduce “unrecognized” cross-border chargebacks.

- What is your SLA for delivering issuer inquiries to us? Minutes matter at the pre-dispute stage.

Metrics That Matter for Cross-Border Chargebacks

Track these KPI families continuously:

- Dispute Ratios by Corridor: Measure cross-border chargebacks per 1000 transactions by country/region, product category, and reason code cluster (fraud, not received, not as described).

- Pre-Dispute Deflection Rate: Percentage of issuer inquiries resolved via Order Insight/Consumer Clarity/RDR before becoming cross-border chargebacks.

- Win-Rate by Evidence Type: How often do you win when you include CE3.0 historical transactions, delivery proof, authentication proof, or customer communications? Use A/B evidence experiments.

- Time-to-Respond: Internal SLA from inquiry receipt to evidence submission.

- Customer Recovery: Post-dispute retention (did the customer buy again after resolution?), which reveals whether cross-border chargebacks reflect confusion or dissatisfaction.

Operational Playbook: Step-by-Step Response to a Cross-Border Chargeback

- Triage by Region & Reason Code: Identify SCA region, network, and reason code (e.g., Visa 10.4).

- Check Pre-Dispute Channels: If it’s still an inquiry, respond through Order Insight or deflect via Consumer Clarity; auto-credit via RDR per your rules for qualifying cases. This alone prevents many cross-border chargebacks.

- Assemble Evidence Quickly: Pull CE3.0-eligible history for Visa fraud CNP disputes; gather delivery and usage logs; add 3DS2/SCA proof.

- Localize & Label: Translate short summaries and use local formats for dates, addresses, and phone numbers.

- Submit Before Your Internal SLA: Don’t aim for the network deadline; aim earlier to account for time zones.

- Log Outcomes & Improve Rules: Feed every win/loss into your risk and RDR rules so fewer cross-border chargebacks repeat.

Technology Stack for Cross-Border Chargeback Management

A modern stack reduces manual work and shrinks cross-border chargebacks:

- Payment Orchestration & Multi-Acquirer Routing: Route by corridor to improve auth rates and use acquirers with strong issuer data-sharing connections.

- 3DS2 Server & SCA Policy Engine: Dynamically invoke challenge vs frictionless, capture authentication data for liability, and retain logs for disputes.

- Dispute Hub Integrations: Connect to Visa Verifi (Order Insight/RDR) and Mastercard Ethoca (Consumer Clarity/Alerts) through your PSP or directly.

- Evidence Automation: Templates that auto-attach CE3.0-qualifying prior transactions, courier events, and CRM interactions for cross-border chargebacks.

- Analytics & BI: Corridor dashboards for dispute rates, win-rates, and lifetime value impact.

Advanced Tactics to Lower Cross-Border Chargebacks Without Killing Conversion

- Use Network Tokens Where Supported: Tokenization can stabilize approvals and reduce false declines, indirectly lowering cross-border chargebacks caused by confused customers retrying payments.

- Smart Subscriptions: For recurring cross-border billing, send proactive reminders, offer local self-serve cancellation, and include brand and plan names that display clearly in issuer apps via data-sharing programs. This reduces “I didn’t authorize” cross-border chargebacks.

- Proactive Post-Purchase Messaging: Send localized delivery updates and duty explanations.

- UX for Recognition: Surface your brand, support email, and local returns link in order confirmation and on-statement descriptor hints.

- Strategic Refunds: If the case is low value, high friction, or weak on evidence, refund early at inquiry or via RDR so it never becomes a counted cross-border chargeback.

FAQs

Q.1: What is the biggest difference between domestic and cross-border chargebacks?

Answer: With cross-border chargebacks, evidence and timing are more challenging due to language, time zones, customs, and varying issuer expectations.

You also see more “unrecognized” disputes because descriptors look unfamiliar in foreign apps. Using issuer data-sharing (Order Insight / Consumer Clarity) and CE3.0-style historical proof can deflect or win many of these cases.

Q.2: Does 3-D Secure (3DS2) always shift liability away from the merchant?

Answer: Not always. In SCA regions, a successful 3DS2 challenge typically shifts fraud liability, while frictionless flows may still shift liability depending on issuer risk-based authentication and local program rules. Keep the 3DS2 proof in your dispute record; it’s crucial when rebutting cross-border chargebacks.

Q.3: How does Visa’s Compelling Evidence 3.0 help with first-party misuse?

Answer: CE3.0 allows merchants to present two prior, non-fraudulent transactions from the same customer 120–365 days before the disputed purchase, plus matching customer identifiers.

When met, issuers may reject friendly-fraud claims under Visa 10.4 at intake or side with the merchant during representation—highly relevant for cross-border chargebacks on CNP sales.

Q.4: Are pre-dispute programs worth the cost?

Answer: Yes for most cross-border sellers. Order Insight, RDR, and Consumer Clarity can resolve many “I don’t recognize this” complaints before they turn into counted cross-border chargebacks, protecting your ratios and saving manual labor. Configure rules to auto-credit low-value or high-risk segments.

Q.5: What evidence carries the most weight in a cross-border case?

Answer: Consistent identity signals across historical purchases (CE3.0 for Visa), itemized receipts and shipping proof, 3DS2/SCA authentication results, and clear refund/return disclosures in the shopper’s language. Organized, localized evidence improves outcomes on cross-border chargebacks.

Conclusion

Cross-border commerce expands your customer base, but it also increases dispute complexity. The merchants who win treat cross-border chargebacks as an operational discipline: enrich issuer views to stop confusion at intake, authenticate smartly with 3DS2, and use CE3.0-ready historical data to overturn first-party misuse.

Localize descriptors and disclosures, publish corridor-specific delivery expectations, and keep evidence templates standardized and fast.

Most importantly, integrate pre-dispute tools like Order Insight, RDR, and Consumer Clarity so international complaints resolve early—before they inflate chargeback ratios. With these steps, cross-border chargebacks become manageable exceptions rather than a recurring drain on margin and team bandwidth.